By CHASE A. DAVIS

CHATTANOOGA (mocsnews.com) – After the Great Recession, the idea of a traditional American lifestyle changed quite dramatically.

With the incorporation of credit on a national scale, also known as the “buy now, pay later” Plan, accessible to the public via companies like PayPal and Klarna, Americans have begun to live above their means and have started to resort to accumulating debt in order to live comfortably.

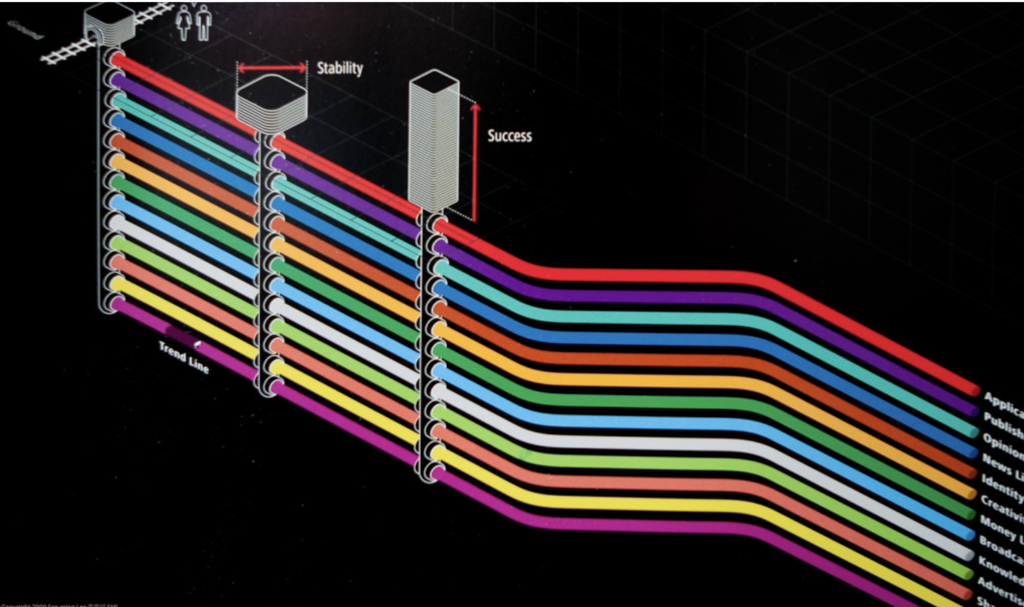

The trend for credit loans has been on the rise over the last couple of decades and shows no signs of slowing down.

And although personnel in the financial industry considered this plan to be effective in the past, inflation, late fees, and economic shifts have caused a major concern to arise throughout the nation.

Priya Krishna, a writer for the New York Times, wrote an article about consumer debt in the food industry where she idintified Josh Roberts, a normal everyday citizen, who used services like Klarna and PayPal to help manage his finances surrounding food. Josh was regularly spending above his means using these services and was very quickly responsible for over five figures worth of consumer debt but learned that the system was only dragging him deeper into the hole.

Mr. Roberts is only one of the millions of people who use credit line platforms to cover their expenses and with the simplicity of registering and applying for, what is essentially a loan, has introduced a very common habit of borrowing money within the population.

Reports show an increase in short and long-term loans over the last several years to be on the rise like never before. According to a report released by the Consumer Financial Protection Bureau, “Americans took out roughly $24.2 billion in loans on ‘buy now, pay later’ programs in 2021, up from only $2 billion in 2019.”

This is a significant statistic considering that the number is predicted to rise even higher in upcoming years, following the trend in rising consumer debt as well.

There are reasons that suggest such an increase in loan rates and consumer debt are inevitable, like government policies being incorporated that may not exactly correlate with the financial convenience of the population, but government involvement is insignificant when considering more US citizens are responsible for more consumer/loan debt than ever before.

More so for the younger generation, there seems to be a direct correlation between debt/loan amounts and lifestyle choices, especially following the recent COVID-19 pandemic and government policy shifts.

There is no way to determine what the future holds regarding economic prosperity, but as Krishna said, “Pay-later users tend to be economically vulnerable,” meaning that if nothing is done to put a cap on the growing rate of loans and debt amounts, the individualistic situations of the overall population could be at an even higher risk for delinquency.

The traditional ‘American Way’ of earning the capacity to live within individualized desired means through labor and services has undergone a realistic warp in previous years.

Unsubscribing to loan/’buy now, pay later’ programs might just be the most effective way to redirect the American economy from a high-debt level nation to a more simplistic and ethical way of life.

Mr. Roberts stated that “If you are not financially literate, it is easy to abuse it and say, ‘I will just keep using it, it is free money,’”

Mocs News Reporting the news that matters most to UTC

Mocs News Reporting the news that matters most to UTC